As an ex-pat living in another country, once in a while, you’ll have to send money to your home country, receive money from or any other part of the world. Back in Malaysia, I used a different money remittance service, which I found the best return for the money I send. But, I could not send the money to Denmark using their service as the bank I was supposed to send wasn’t on their list. Read below for why I chose Transferwise to transfer money. I asked my friends who are in Europe, how do they send money. Almost everyone suggested Transferwise. Until that moment, I haven’t used it and also I wasn’t sure how much money I’ll be losing with the exchange rate. Also, I was in need to send the money as soon as possible.

I was checking with a few other services for their exchange rates. But there is hardly any to beat their exchange rate. Also, when you add the transaction fees and charges, I couldn’t find any other services cheaper than Transferwise.

How To Register

The registration process was very fast and easy. I did the registration directly through the app. You can download the Android app here. You have to submit a valid id, I submitted a copy of my passport, and a selfie to verify. The verification process was fast and the account was activated within a couple of hours. It is possible to use the service in any other country after the initial verification.

Sending Money

You must add beneficiary before you send the money. You must make sure the account information is correct. If it is an IBAN (International Bank Account Number), you can check if the number is valid from the Transferwise IBAN checker website.

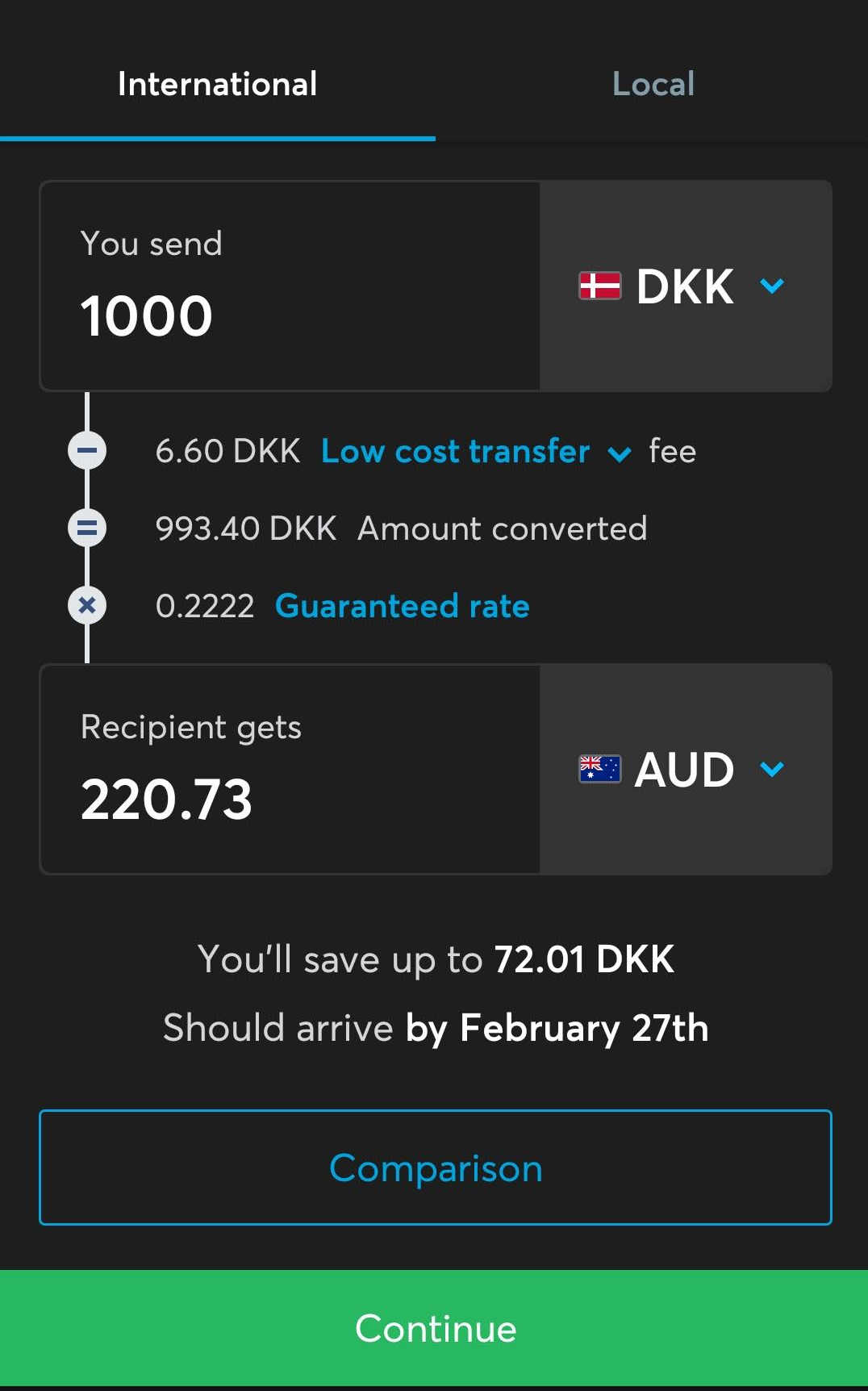

Select the beneficiary and the amount. Transferwise has several options to transfer the money to their account. Payment through debit or credit card adds extra charges. I always choose the bank transfer option which is the cheapest. Next, the app will show the bank details to which you have to send the money and a reference number. It’s a Transferwise local bank account. When you transfer the money to their account, make sure to mention the reference number. They find your amount based on it.

The actual transfer process starts from the moment the money arrives at their account. You can track the transfer status in the app. In my experience, from the time the actual transfer started, the money reaches within 24 to 30 hours. After the successful transfer, you will receive the download receipt link to your email.

You can check the list of countries that supports Transferwise here. One more reason I really like to use Transferwise is customer support. In my first transaction, I had some issues regarding payment to their bank account, and it was late in the evening in Malaysia. Since it has offices in several countries, I could call directly to the UK office for a quick response and I could talk to a real person than a support bot.

Multiple Currencies and Accounts

It is possible to create multiple currency accounts in Transferwise. It is possible to get bank details for the following currencies: USD, GBP, EUR, AUD, NZD, and Polish currency. You will get the bank details with IBAN numbers or the Swift code to receive money.

Debit Card

If you have a European account, it is possible to order a Transferwise debit card. You have to add a small amount depending on the currency that you are choosing to order the card. This is not a fee, and when the card arrives, you can use that amount. This was very useful for me during our first few weeks in Denmark. When we moved here, I didn’t have a Danish bank account. I ordered the card as soon as we arrived here and received it within 2 weeks. I could add the money to the Transferwise Danish account and used it. Also, if you’re traveling, it is possible to add the amount that you will be using in your destination to avoid extra charges. You can read more about the charges here.

Transferwise Calculator

You can easily calculate the amount you’ll be receiving and the charges using the following calculator

Price Comparison Table

If you need a price comparison overview with other services, you can do that below.

The true cost of sending EUR to GBPReady to dig in? Check out the Transferwise Story below.